What Is The Limit For Section 179 . This limit is reduced by the amount by which the cost of section. Web the maximum deduction under section 179 is $1,160,000 for the 2023 tax year (taxes that were due in 2024). Physical property such as furniture, equipment, and most. Web to qualify for a section 179 deduction, your asset must be: All companies that lease, finance or purchase business equipment valued at less than $3,050,000. Web for tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000. If you placed more than $2,890,000. Web for the 2023 tax year, section 179 deduction allows business owners to deduct up to $1,160,000 ($1,220,000 for.

from yourabt.com

Web for tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000. This limit is reduced by the amount by which the cost of section. Web to qualify for a section 179 deduction, your asset must be: If you placed more than $2,890,000. Web the maximum deduction under section 179 is $1,160,000 for the 2023 tax year (taxes that were due in 2024). Web for the 2023 tax year, section 179 deduction allows business owners to deduct up to $1,160,000 ($1,220,000 for. Physical property such as furniture, equipment, and most. All companies that lease, finance or purchase business equipment valued at less than $3,050,000.

Blog Sect 179 Maximize your Tax Deductions

What Is The Limit For Section 179 Web to qualify for a section 179 deduction, your asset must be: Web the maximum deduction under section 179 is $1,160,000 for the 2023 tax year (taxes that were due in 2024). Web for the 2023 tax year, section 179 deduction allows business owners to deduct up to $1,160,000 ($1,220,000 for. If you placed more than $2,890,000. Physical property such as furniture, equipment, and most. This limit is reduced by the amount by which the cost of section. Web to qualify for a section 179 deduction, your asset must be: Web for tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000. All companies that lease, finance or purchase business equipment valued at less than $3,050,000.

From www.curchin.com

Section 179 Deduction Limits Getting the Most out of Your Tax What Is The Limit For Section 179 This limit is reduced by the amount by which the cost of section. If you placed more than $2,890,000. Web to qualify for a section 179 deduction, your asset must be: Web for the 2023 tax year, section 179 deduction allows business owners to deduct up to $1,160,000 ($1,220,000 for. Web for tax years beginning in 2023, the maximum section. What Is The Limit For Section 179.

From martellewcassie.pages.dev

Section 179 Limit 2024 Lenka Nicolea What Is The Limit For Section 179 Web the maximum deduction under section 179 is $1,160,000 for the 2023 tax year (taxes that were due in 2024). If you placed more than $2,890,000. Web for tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000. Web to qualify for a section 179 deduction, your asset must be: Physical property such as furniture, equipment, and. What Is The Limit For Section 179.

From www.prweb.com

Expiration Of Current Section 179 Tax Deduction Limit On 12/31/13 What Is The Limit For Section 179 Web for tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000. Physical property such as furniture, equipment, and most. If you placed more than $2,890,000. Web for the 2023 tax year, section 179 deduction allows business owners to deduct up to $1,160,000 ($1,220,000 for. Web the maximum deduction under section 179 is $1,160,000 for the 2023. What Is The Limit For Section 179.

From www.dovercdjr.com

Section 179 Tax Deduction How to Qualify Learn More What Is The Limit For Section 179 This limit is reduced by the amount by which the cost of section. Web to qualify for a section 179 deduction, your asset must be: If you placed more than $2,890,000. Web the maximum deduction under section 179 is $1,160,000 for the 2023 tax year (taxes that were due in 2024). Web for tax years beginning in 2023, the maximum. What Is The Limit For Section 179.

From www.cardiacdirect.com

Section 179 Tax Deduction for Medical Purchases (2023) CardiacDirect What Is The Limit For Section 179 Web to qualify for a section 179 deduction, your asset must be: Web for the 2023 tax year, section 179 deduction allows business owners to deduct up to $1,160,000 ($1,220,000 for. If you placed more than $2,890,000. All companies that lease, finance or purchase business equipment valued at less than $3,050,000. This limit is reduced by the amount by which. What Is The Limit For Section 179.

From yourabt.com

Blog Sect 179 Maximize your Tax Deductions What Is The Limit For Section 179 Web to qualify for a section 179 deduction, your asset must be: Web for the 2023 tax year, section 179 deduction allows business owners to deduct up to $1,160,000 ($1,220,000 for. If you placed more than $2,890,000. Web for tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000. Web the maximum deduction under section 179 is. What Is The Limit For Section 179.

From solutions.travers.com

Reduce Your Taxes With The Section 179 Deduction What Is The Limit For Section 179 Web the maximum deduction under section 179 is $1,160,000 for the 2023 tax year (taxes that were due in 2024). All companies that lease, finance or purchase business equipment valued at less than $3,050,000. Web for the 2023 tax year, section 179 deduction allows business owners to deduct up to $1,160,000 ($1,220,000 for. If you placed more than $2,890,000. This. What Is The Limit For Section 179.

From www.netsapiens.com

Section 179 IRS Tax Deduction Updated for 2020 What Is The Limit For Section 179 Web to qualify for a section 179 deduction, your asset must be: If you placed more than $2,890,000. Web the maximum deduction under section 179 is $1,160,000 for the 2023 tax year (taxes that were due in 2024). All companies that lease, finance or purchase business equipment valued at less than $3,050,000. Physical property such as furniture, equipment, and most.. What Is The Limit For Section 179.

From www.beaconfunding.com

Section 179 Deduction Limit for 2022 What Is The Limit For Section 179 Web for tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000. All companies that lease, finance or purchase business equipment valued at less than $3,050,000. Web for the 2023 tax year, section 179 deduction allows business owners to deduct up to $1,160,000 ($1,220,000 for. If you placed more than $2,890,000. This limit is reduced by the. What Is The Limit For Section 179.

From darrequipment.com

Is Section 179 Right for Your Business? Darr Equipment What Is The Limit For Section 179 Physical property such as furniture, equipment, and most. This limit is reduced by the amount by which the cost of section. If you placed more than $2,890,000. Web for the 2023 tax year, section 179 deduction allows business owners to deduct up to $1,160,000 ($1,220,000 for. Web for tax years beginning in 2023, the maximum section 179 expense deduction is. What Is The Limit For Section 179.

From daceyblaraine.pages.dev

Section 179 Limit For 2024 Alie Lucila What Is The Limit For Section 179 Web to qualify for a section 179 deduction, your asset must be: Web the maximum deduction under section 179 is $1,160,000 for the 2023 tax year (taxes that were due in 2024). Web for the 2023 tax year, section 179 deduction allows business owners to deduct up to $1,160,000 ($1,220,000 for. Web for tax years beginning in 2023, the maximum. What Is The Limit For Section 179.

From imageworkscorporation.com

What Dentists Need to Know About Section 179 in 2023 What Is The Limit For Section 179 Web to qualify for a section 179 deduction, your asset must be: Web for the 2023 tax year, section 179 deduction allows business owners to deduct up to $1,160,000 ($1,220,000 for. All companies that lease, finance or purchase business equipment valued at less than $3,050,000. Web the maximum deduction under section 179 is $1,160,000 for the 2023 tax year (taxes. What Is The Limit For Section 179.

From bellamystricklandisuzutrucks.com

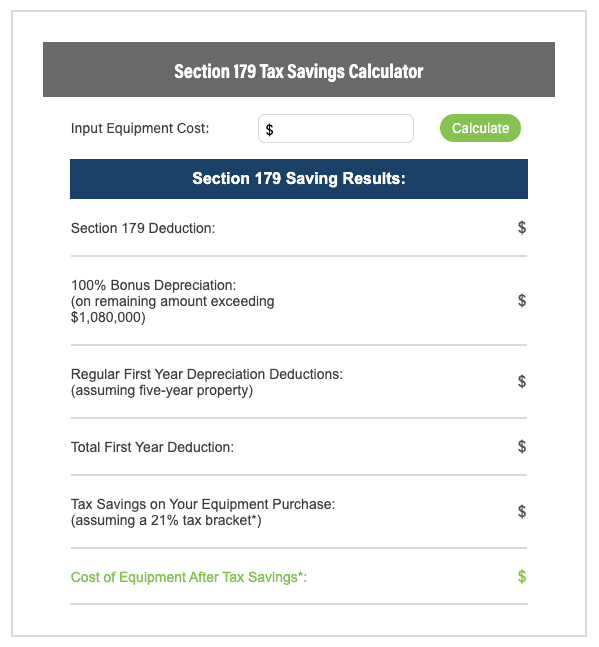

section 179 calculator What Is The Limit For Section 179 Web the maximum deduction under section 179 is $1,160,000 for the 2023 tax year (taxes that were due in 2024). Web for tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000. If you placed more than $2,890,000. All companies that lease, finance or purchase business equipment valued at less than $3,050,000. Web for the 2023 tax. What Is The Limit For Section 179.

From ag.purdue.edu

Depreciation and Expensing Options Center for Commercial Agriculture What Is The Limit For Section 179 All companies that lease, finance or purchase business equipment valued at less than $3,050,000. Web to qualify for a section 179 deduction, your asset must be: If you placed more than $2,890,000. Physical property such as furniture, equipment, and most. Web the maximum deduction under section 179 is $1,160,000 for the 2023 tax year (taxes that were due in 2024).. What Is The Limit For Section 179.

From willytwbrooks.pages.dev

Section 179 Deduction Limit 2024 Margo Sarette What Is The Limit For Section 179 Web to qualify for a section 179 deduction, your asset must be: If you placed more than $2,890,000. All companies that lease, finance or purchase business equipment valued at less than $3,050,000. Web for the 2023 tax year, section 179 deduction allows business owners to deduct up to $1,160,000 ($1,220,000 for. Physical property such as furniture, equipment, and most. Web. What Is The Limit For Section 179.

From www.calt.iastate.edu

Iowa Department of Revenue Issues Proposed Rules for Section 179 What Is The Limit For Section 179 Web to qualify for a section 179 deduction, your asset must be: This limit is reduced by the amount by which the cost of section. Web for the 2023 tax year, section 179 deduction allows business owners to deduct up to $1,160,000 ($1,220,000 for. Web the maximum deduction under section 179 is $1,160,000 for the 2023 tax year (taxes that. What Is The Limit For Section 179.

From www.workamajig.com

Section 179 Deduction A Guide for Creative Agencies What Is The Limit For Section 179 Web for tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000. Web the maximum deduction under section 179 is $1,160,000 for the 2023 tax year (taxes that were due in 2024). All companies that lease, finance or purchase business equipment valued at less than $3,050,000. This limit is reduced by the amount by which the cost. What Is The Limit For Section 179.

From www.linkedin.com

Section 179 Deduction Limit for 2023 What Is The Limit For Section 179 This limit is reduced by the amount by which the cost of section. Web for the 2023 tax year, section 179 deduction allows business owners to deduct up to $1,160,000 ($1,220,000 for. Web to qualify for a section 179 deduction, your asset must be: Web the maximum deduction under section 179 is $1,160,000 for the 2023 tax year (taxes that. What Is The Limit For Section 179.